CLS Management System(CFO)

This is a financial system that helps mitigate settlement risks in simultaneous multicurrency settlements.

Management System for CLS Settlement Operations

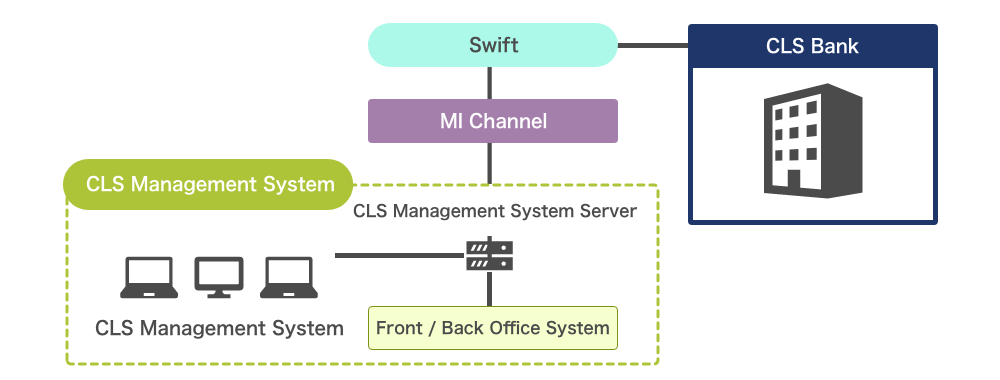

Ever since the startup of CLS Bank in 2002, NTT DATA Luweave has provided a CLS Management System (CFO : CLS Finality Organizer) with all the necessary functions for CLS (Continuous Linked Settlement) settlement operations. As a packaged solution for CLS settlement members, the CLS Management System has functions for collecting foreign exchange confirmation information from front office systems, direct transmission to CLS, transaction status/liquidity usage monitoring, automatic collation of transaction status against the Pay-In schedule, automatic payment message generation, settlement status/CLS-related account monitoring, and third-party commissioning services, among others.

Ever since the startup of CLS Bank in 2002, NTT DATA Luweave has provided a CLS Management System (CFO : CLS Finality Organizer) with all the necessary functions for CLS (Continuous Linked Settlement) settlement operations. As a packaged solution for CLS settlement members, the CLS Management System has functions for collecting foreign exchange confirmation information from front office systems, direct transmission to CLS, transaction status/liquidity usage monitoring, automatic collation of transaction status against the Pay-In schedule, automatic payment message generation, settlement status/CLS-related account monitoring, and third-party commissioning services, among others.

Features and Advantages

- Provides an interface between CLS Member Gateway and front/back office systems

- Flexible system support in line with the CLS System and customer needs

- A solution that combines the benefits of packaging and customization

- Development and implementation of the interface with back office systems, as well as those for additional requirements, can be entirely left to us

- The system can be customized to individual needs and comes with prompt support

Maintenance Services

Reliable system maintenance services are provided to ensure stable operations.

- Bilingual support (Japanese and English)

- Remote and on-site support

- 24/7/365 support

- Various information on Swift and CLS (system/technical perspectives, etc.)

Reliable Service with Proven Track Records

- Extensive experience as a long-established solution provider since the launch of CLS Bank

- Successful handling of changes in the market infrastructure since the 1990s

- An official CLS Registered Plus Vendor

We support your operations end-to-end by establishing external connections, STP, and related applications, among others, in order to manage responses to service providers and market infrastructures such as CLS and other clearing and settlement member institutions operating on Swift as their network infrastructure.