Solutions for Financial Institutions

Professional Services Leading the Way toward Innovation of Financial Systems

NTT DATA Luweave, with a history of half a century in the settlement systems field and two decades in the area of market trading/risk management, has provided the financial industry with solutions as a leading company in each of these areas.

To keep up with the changing state of finance and the advance of institutional reform and globalization, highly specialized knowledge and advanced technologies are needed in financial solutions as well. In high-level consulting, merging our knowledge of financial operations with information technology expertise, we propose ways of heightening business performance.

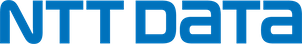

■ Settlement systems

Top Player in the Field of Payment Systems

With advanced business knowledge and technical expertise, our professional teams provide solutions in our main financial business areas: Swift, Anti-Money Laundering (AML) and Bank of Japan Net (BOJ-NET) connectivity. Our one-stop solutions encompass consultation services, systems development and implementation as well as maintenance and support.

■ Market trading risk management

A Top Performer in Japan, Staying Closely Attuned to the Needs of Users

It has been around twenty years since we started offering our financial market trading/risk management solutions. By continuing to develop solutions while listening closely to users, we became a top performer domestically with multiple solutions. Continuing to make the most of our strengths while staying attuned to user needs, we aim to create new value as a leading company in this field.

- Applying the expertise in the Advanced Financial Engineering Center to solutions development

- Development and provision of multiple solutions with the number one ranking in domestic deployments (2022, our estimates)

- Helping customers’ value creation by provision of end-to-end solutions and services

- Collaborating with a wide range of market participants to provide solutions reflecting the latest knowledge

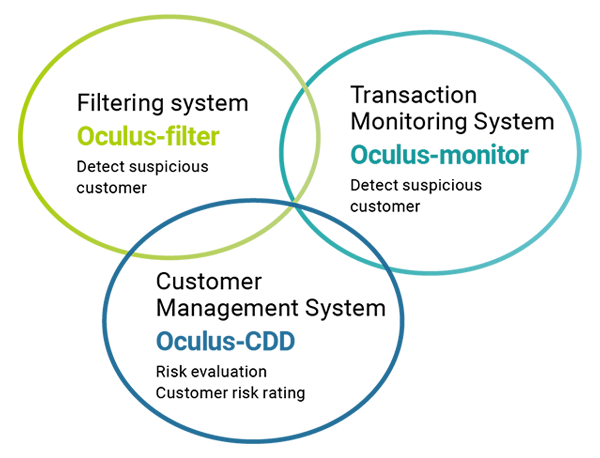

■ Financial crime countermeasures

The Oculus® Series AML System, developed by us, cross-links filtering, monitoring, and customer management functions to enable integrated management. Continuing to reflect updates to laws, regulations, and guidelines, it is used by more than 300 financial institutions, including shared-use services.

■ GRC (Governance Risk Compliance)

Providing best practices learned from numerous global use cases, this platform brings efficiency and greater certainty to risk management operations. Our team of experts supports solution deployment based on our experience in this area since the early days of GRC solutions in Japan.