Anti-money Laundering System "Oculus® Serise"

Supporting the Advancement of Anti-Money Laundering and Terrorism Financing from a Global Perspective

Anti-Money Laundering (AML) encompasses a broad range of activities, including the elimination of unnatural transactions, wire transfer fraud and other fraudulent account transactions, anti-social forces, terrorist financing, and loan fraud. As the modus operandi of money laundering and terrorist financing becomes increasingly complex, the countermeasures required of financial institutions are also changing significantly.

NTT DATA Luweave has been involved in the development of anti-money laundering and anti-terrorist financing systems and their implementation in financial institutions since around 2000. We were among the first in Japan to train international anti-money laundering professionals and now have a team of experts certified under the CAMS (Note 1) program in the United States. In cooperation with the authorities, financial institutions, and information providers, we contribute to the fight against money laundering and terrorist financing in Japan by reforming operational management processes, including business aspects, and by effectively taking AML measures based on the risk-based approach required at the international level.

(Note 1) CAMS (Certified Anti-Money Laundering Specialist) is an international certification granted by ACAMS® (Association of Certified Anti-Money Laundering Specialists®) to personnel involved in AML.

Features and Advantages

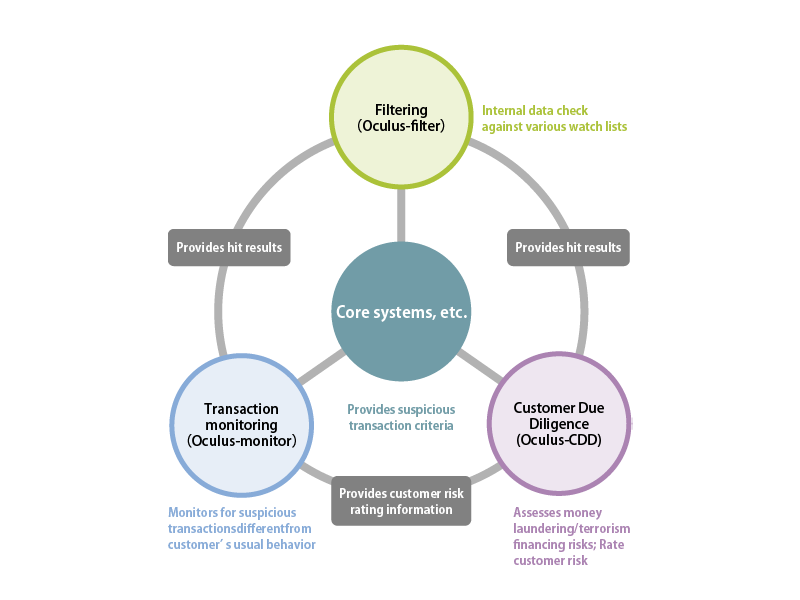

AML System (Oculus® Series)

Consisting of three products (Oculus®-filter, Oculus®-monitor, and Oculus®-CDD) replete with the functions needed by financial institutions for AML operations, this solution eases the burden for the prevention of increasingly diverse fraudulent transactions.

Oculus®-filter (Filtering)

This solution seeks to prevent terrorism financing in foreign remittances, by screening against various lists, including economically sanctioned individuals (frozen assets, etc.), anti-social forces, the Office of Foreign Assets Control (OFAC), EU, PEPs (Politically Exposed Persons) and the foreign country lists of the Ministry of Economy, Trade and Industry. It also facilitates the monitoring of new bank account openings and the verification of existing business relationships.

Oculus®-monitor (Transaction Monitoring)

This solution detects suspicious transactions that deviate from the customer’s usual transaction history and patterns. It provides specialized services ranging from simple scenarios, such as wire transfer fraud, to the profiling of highly sophisticated criminal methods.

Oculus®-CDD (Customer Management)

This product establishes risk-scoring rules for money laundering and terrorism financing based on risk assessment reports prepared by the financial institution. It calculates an aggregate score reflecting the customer’s money laundering risk. The risk rating information is not only retained in the AML system but can also be utilized to weigh what level of action should be taken when interviewing the customer or to restrict or suspend the customer’s transactions by updating the information in the core system as necessary.

Use Environment

The Oculus Series can be used in a form best suited to the customer environment, with the options of on-premises, shared use, or system-as-a-service.

On-premises: The Oculus Series is installed in the customer’s data center or other facility.

Shared use: Access is provided to the Oculus Series installed in a shared center or other facility housing the banking system.

System-as-a-service: Access is provided to the Oculus Series installed in an outside data center.

Shared Use by Multiple Financial Institutions

The Oculus Series is available for joint use by multiple financial institutions. Users in a shared environment have access to the same functionalities as those available to users in independent setups.