Thank you for visiting us at Sibos 2014 in Boston, held from September 29 to October 2.

Sibos 2014 was the 36th SWIFT annual conference, and the third held in Boston. With over 7,000 attendees, of whom 48% came from Europe, the Middle East and Africa, 38% from the Americas, and 14% from the Asia-Pacific region, the conference had 170 exhibitors. 19 members of the NTT DATA Getronics teams attended the event. In returning to the capital of Massachusetts, Sibos celebrated another SWIFT achievement by establishing two new industry trends: Sibos University and the Investment Manager Forum.

This report provides a link to our Sibos 2014 contributions, focusing on the TSU/BPO speech given at the Open Theatre. Whether you attended the Boston event or not, this report offers a key message for the industry and helps to explain an industry trend.

NTT DATA Getronics at Sibos 2014 in Boston

Co-exhibiting with the NTT DATA Group, we designed our booth to reflect the partnership between IndyCar and NTT DATA Inc., drawing on the themes of IndyCar Speed, Innovation, and Teamwork.

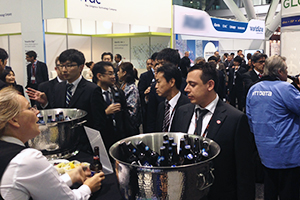

One of our most enjoyable annual events, the Happy Hour held on the second day, was attended by more than 50 of our clients who joined us to share drinks and food.

[Open Theatre - TSU/BPO: Is paper still essential for trade transactions?]

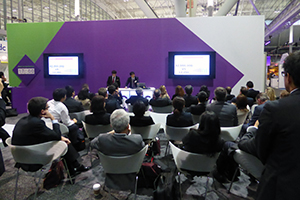

Back in 2013 in Dubai, our Open Theatre session posed the question, "Why isn't SUSHI BAR generated as an alert?" — focusing on Anti-Money Laundering (AML) solutions. On the third day in Boston, NTT DATA Getronics held a collaborative session with one of our Tokyo clients, Daisuke Kamai, Head of e-products at the Bank of Tokyo-Mitsubishi UFJ (hereafter BTMU).

Head of e-Trade Product, Transaction Banking Division,

The Bank of Tokyo-Mitsubishi UFJ, Ltd.

Mr. Daisuke Kamai

General Manager, Financial Business Sales Department 3

NTT DATA Getronics Corporation

Mr. Toshihiro Fukao

The Supply Chain Finance business has been steadily growing in recent years, leading to the publication of the ICC's Bank Payment Obligation (BPO) rules. In response, SWIFT decided to release the Trade Service Utility (TSU), a new matching system for trade documents. In the Open Theatre, we discussed with Mr. Kamai how BTMU adopted TSU/BPO and the implementation of our collaborative system.

The publication by ICC and the TSU system release led BTMU to launch, in July 2013, a new TSU/BPO settlement service with one of their clients. BTMU was the first bank in the world to provide this service. An alternative means of settlement in international trade, the BPO offers the benefits of a letter of credit (L/C) electronically, without the need for manual processing (usually associated with legacy trade finance). BTMU shared their experience of adopting TSU/BPO and showed how they had expanded their global services, taking three key steps to provide their clients with a TSU/BPO solution.

The number of banking groups and corporations with a live BPO program has been growing steadily since more than 50 people attended our Open Theatre session with BTMU, which offered a practical case study on TSU/BPO solutions.

Daisuke Kamai has commented on the SWIFT report:

"BPO addresses the challenges that we were facing in our trade finance business in the past; it allows us to evolve with the market and provides a new range of solutions to meet the ever-changing needs of our trade customers, both on L/C and open account. We are happy to be the first BPO provider in the Asian market."

(Source: http://www.swift.com/assets/corporates/documents/business_areas/trade_bpo_market_adoption.pdf)

Our activity

[ISO20022]

2014 marks the 10th birthday of the XML standard ISO20022, established as a standard messaging format for Market Infrastructures, corporations, and banks. Discussions on this topic evolved from concept-level (in the early years) to the point where parties today are talking about migrating and implementing the ISO20022 format.

NTT DATA met with Central Banks from a number of foreign countries, as well as top banks from around the world, to further discuss trends and the implementation of the ISO20022. It was a great opportunity for us to demonstrate one of our key solutions, the Financial Message Broker 7.0, which is fully ISO20022-ready.

[CLS(Continuous Linked Settlement)Bank]

Since the CLS Bank began operations in 2002, NTT DATA Getronics has been selected as a Registered Plus Vendor, working closely with financial institutions to support their CLS operations. Our experts have not only attended CLS sessions but have met with the CLS Bank to share the latest updates and discuss SDS (Same-Day Settlement) trends.

[Payment trends]

The new payment system trends were discussed at Sibos 2014, along with recent innovations in the payments industry, such as the launch of online banking and non-bank payment systems including Bitcoin, Apple Pay, PayPal, and M-PESA. The liveliest discussions of Sibos 2014 involved the seamless expansion of various services, including the 24/7 service of the ACH (Automated Clearing House), real time payment systems, and cross border connectivity. As a leading solution vendor in the payments industry, we attended over 10 sessions on payment trends and gathered information on current global payment schemes, which cross borders between countries and industries.

Related links

Sibos 2015

The October 2015 Sibos conference will return to Singapore for the first time since 2003. Future events are planned for Geneva, Toronto, and Sydney. We look forward to seeing you in Singapore!