NTT DATA Group to Start Offering a Centralized Support System for Payment and Settlement Operations through the New Bank of Japan Financial Network System

- Cloud-based services to enable faster and more efficient services -

Press Releases

December 25, 2012

NTT DATA Corporation

NTT DATA Getronics Corporation

Japan Information Processing Service Co., Ltd.

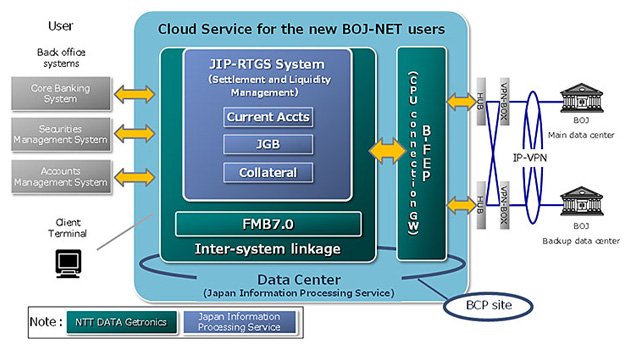

NTT DATA Group today announced that it will start offering a cloud service in FY 2014 to provide financial institutions a centralized support for linkage with the new Bank of Japan Financial Network System (hereinafter referred to as BOJ-NET) and settlement management. The service will be based on packaged products that are currently being provided by NTT DATA Group companies to support BOJ-NET linkage and settlement operations of financial institutions using BOJ-NET.

- [ Background ]

- The BOJ-NET (Bank of Japan Financial Network System) is a network constructed for the purpose of online processing payment and settlement of funds and government bonds between the Bank of Japan and financial institutions. Starting from FY 2013, the new BOJ-NET will start its operation in two stages, in order to improve the flexibility and accessibility of the system and ensure future possibilities in response to increasingly networked payment and settlement infrastructures, globalized financial transactions and changes in the type of or needs for financial services in the future.

In the second stage starting in FY 2015, financial institutions using CPU connection(*1) will need to change communication control and support the XML format(*2) messages. In addition, liquidity management for current accounts and government bonds in accordance with the new BOJ-NET's settlement method is required; therefore every financial institution must revamp its system to be compatible with the new BOJ-NET.

NTT DATA Group has been providing a gateway package system for users that make CPU connection to the BOJ-NET called "B-FEP", and a packaged system to manage the settlement and liquidity of financial institutions through the Bank of Japan account called "JIP-RTGS system" for more than a decade, as support systems for payment and settlement operations in compliance with the regulations stipulated by the BOJ-NET. In preparation for the launch of the new BOJ-NET, the Group has already started to make both packages be ready for the new BOJ-NET.

In these circumstances, NTT DATA Group will offer these systems required by financial institutions to connect to the new BOJ-NET, not only as conventional packaged products provided by our group companies but also as a cloud service by delivering both packaged systems as a cloud-based system and by integrating functions required for the connection to the new BOJ-NET. This will allow financial institutions to prepare for the connection to the new BOJ-NET in a short period of time with reduced costs.

Outline (features) of the service

- Offering of a cloud-based and centralized support system for payment and settlement operations through the new BOJ-NET

The advantage of Japan Information Processing Service's data center and NTT DATA Getronics' transaction banking application "FMB7.0" is that it makes it possible to build a cloud service that can establish a smooth link between "B-FEP" and "JIP-RTGS system" for the financial institutions connected to the new BOJ-NET.

The service will offer the centralized provision of all functions required for connecting to the new BOJ-NET by supporting the connection to different back office systems of each financial institution and "JIP-RTGS system".

- Cloud-based service to reduce the costs of the implementation/operation of the system

In comparison to a case where each financial institution constructs its system individually, financial institutions can cut down hardware assets, which leads to fast introduction of the system and the reduction in the costs of the implementation/operation. This will result in the curbing of additional investments, particularly for financial institutions that are planning to change from terminal connection to CPU connection in accordance with the launch of the new BOJ-NET.

Roles of the Three Companies

The role of each company is as described below

- NTT DATA

Overall management and sales promotion of the cloud service - NTT DATA Getronics

Support of "B-FEP", a gateway packaged system for CPU connection to the BOJ-NET, for the new BOJ-NET, and sales of the cloud service - Japan Information Processing Service

Support of "JIP-RTGS system", a packaged system to manage the settlement and liquidity of financial institutions through the Bank of Japan account, for the new BOJ-NET, operation of the service of "B-FEP" and "JIP-RTGS system" at its data center, and sales of the cloud service

Future Plan

NTT DATA Group is aiming to achieve total sales of two billion yen by FY 2017 with this service.

In addition, with regard to infrastructure systems in the field of funds/securities settlement, besides the new BOJ-NET, Japan Securities Depository Center, Incorporated (JASDEC) is planning its next system maintenance/update. We will offer settlement solutions compatible with the next JASDEC system using "FMB7.0" as a service for financial institutions and securities companies that must revamp their system in response to the new connection requirements.

Making use of software package systems of NTT DATA Group companies including NTT DATA Getronics and Japan Information Processing Service, we will continue to develop new solutions to support not only payment and settlement operations but also a wider range of funds/securities operations.

Reference

- "B-FEP", a gateway package system for CPU connection to the BOJ-NET

"B-FEP", developed by NTT DATA Getronics, is a gateway package specific to the connection to the BOJ-NET, which is sufficiently useful for financial institutions with high volume of transactions.

For the new BOJ-NET, a high quality and highly advanced package will be available in line with the conventional products.

- "JIP-RTGS system", a package system to manage the settlement and liquidity of financial institutions through the Bank of Japan account

"JIP-RTGS system", developed by Japan Information Processing Service, is a settlement management system compatible with RTGS in the BOJ-NET. This provides a centralized management of operation data to control and reconcile settlement instructions, and manages the outstanding balance of current accounts and government bonds.

- Transaction banking application "FMB7.0"

"FMB7.0", developed by NTT DATA Getronics, is a product (service) group of the STP functions partitioned by components, each of which is required for global transaction banking infrastructure. In the message conversion component, not only ISO20022 format but also other data formats including fixed length, SWIFT and XML are supported.

- (*1)CPU connection

Sending and receiving payment and settlement data by directly connecting computers at financial institutions to the host computer at the Bank of Japan over leased lines. The alternative to CPU connection is the use of dedicated terminals that connects to the host computer. - (*2)Support for XML format

XML is the computer language describing the definition and structure of documents and data. BOJ-NET CPU connection participants need to correspond to XML which will be a compatible format in the new BOJ-NET.

* "FMB" is a registered trademark of NTT DATA Getronics Corporation in Japan.

* Other product, company and group names are trademarks or registered trademarks of their respective companies.