NTT DATA Launches Generative AI-Powered Address Structuring Service to Support ISO20022 Migration

Automatically Structuring Irregular Address Data with Generative AI to Reduce the Operational Burden of Data Migration for Financial Institutions and Corporations

March 26, 2025

NTT DATA Japan Corporation and NTT DATA Luweave Corporation announced today that they have jointly launched a new service that leverages generative AI to automatically and efficiently structure irregular address data held by financial institutions and corporations. Several financial institutions and commercial enterprises are scheduled to adopt the service.

This service enables automatic structuring of address data, such as those stored in internet banking remittance templates and customer management systems, into itemized formats using generative AI.

The structured data can then be seamlessly converted to the new ISO20022 format (*1), significantly reducing the complexity and errors associated with entering diverse international address formats. This will contribute to smoother and more efficient cross-border payments.

In response to growing demand for digital transformation (DX) and IT modernization both in Japan and globally, the service has been designed to support both Japanese and English. By leveraging group-wide assets, NTT DATA and NTT DATA Luweave aim to expand the service globally in collaboration with local group companies around the world.

Going forward, NTT DATA and NTT DATA Luweave will continue to utilize generative AI to support financial institutions and corporations in addressing regulatory changes and operational challenges, delivering more efficient and reliable solutions.

1.Background

Swift (*2), an organization operating a major international financial telecommunications network that transmits international payment instructions, has announced that by November 2025, it will fully transition to ISO20022, the new global messaging standard for financial communications. While the current MT format will remain available until November 2025, Swift plans to exclusively support the new MX format thereafter. As a result, financial institutions and corporations involved in cross-border payments must update their messaging systems to comply with ISO20022 by the deadline. This includes the migration of address data, which presents a significant challenge due to the lack of standardized address definitions across countries. The definition and components of postal addresses vary greatly from country to country.

The order of house numbers, the treatment of building names, and the positioning of postal codes are deeply rooted in each country's culture and administrative system. Despite this fact, there is no information source that provides comprehensive access to address structures around the world. Swift currently publishes address structuring definitions that comply with ISO20022 for only 33 countries, but for the remaining 200+ countries and regions, there are no clear guidelines on how address information should be structured in a manner that complies with ISO20022. This lack of coverage poses a major obstacle to efficient migration efforts.

In response to this challenge, NTT DATA and NTT DATA Luweave have developed the ISO Address Structuring Service, leveraging advanced data processing technologies and deep expertise in ISO20022 compliance. The service enables accurate and efficient bulk structuring of address data, supporting smooth migration to the new standard.

2. Service Overview

The ISO Address Structuring Service was jointly planned and developed by NTT DATA and NTT DATA Luweave. With STRUCTURIZ™ (*3), which enables address structuring compliant with the fully-structured format (*4), as its core function, the service has been built on NTT DATA's secure cloud infrastructure and is provided to financial institutions and commercial companies as a shared-use service. This architecture enables financial institutions and corporations to adopt the service without the need for individual system development, allowing for cost-effective, rapid, and efficient migration to ISO 20022.

(1) Value Proposition

This service offers two usage methods to meet the diverse needs of companies, enabling it to be used in a variety of scenarios.

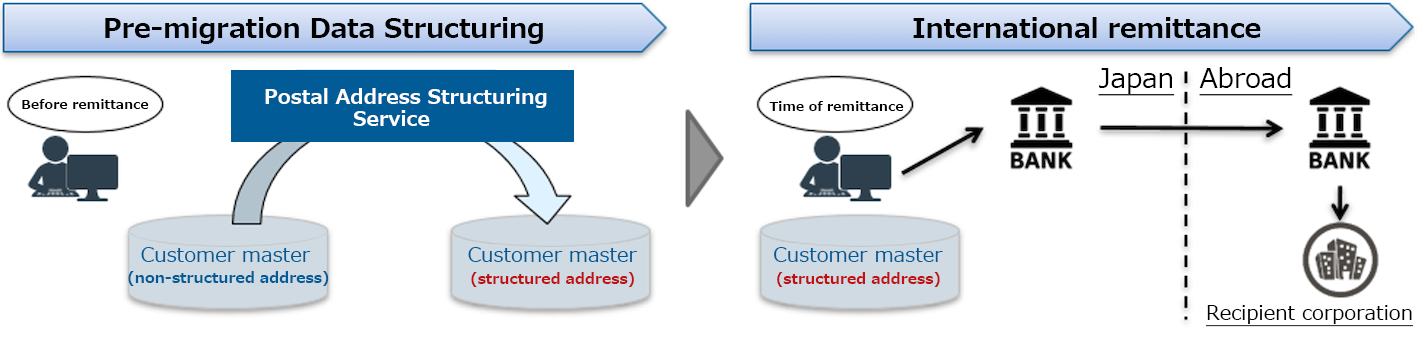

a. Pre-Migration Data Structuring

Customer information—including address data—stored in the systems of financial institutions and corporations can be pre-structured in advance of ISO 20022 migration. At the time of remittance, operators can simply refer to the already structured address data, ensuring smooth and compliant message generation.

Example: Pre-structuring a corporation’s ERP system internal data

Fig. 1. Conceptual Diagram of Pre-migration Data Structuring

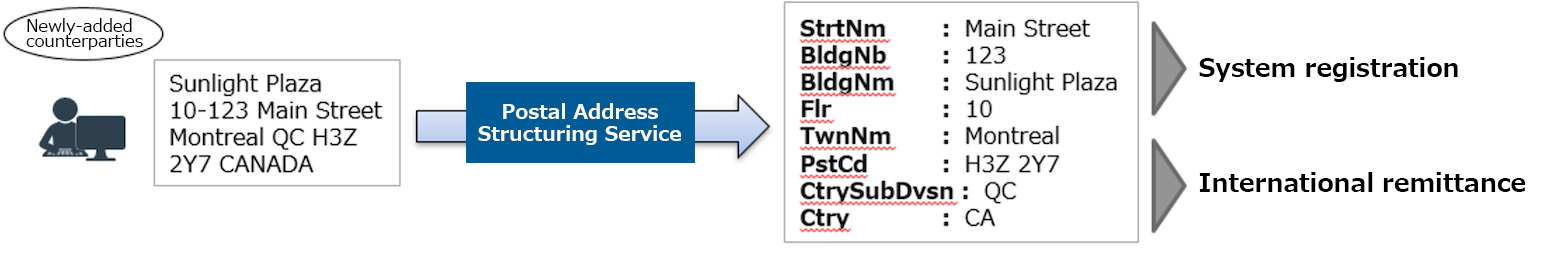

b. Real-Time Structuring (service launch scheduled for early summer 2025)

Following the pre-migration phase, the service also enables on-demand structuring of address data for newly added counterparties. This allows financial institutions and corporations to consistently perform system registrations and remittance operations using fully structured address information, ensuring continued compliance and operational integrity.

Example: Real-time structuring for non-registered, newly-added counterparties

Fig. 2. Conceptual Diagram of Real-time Migration

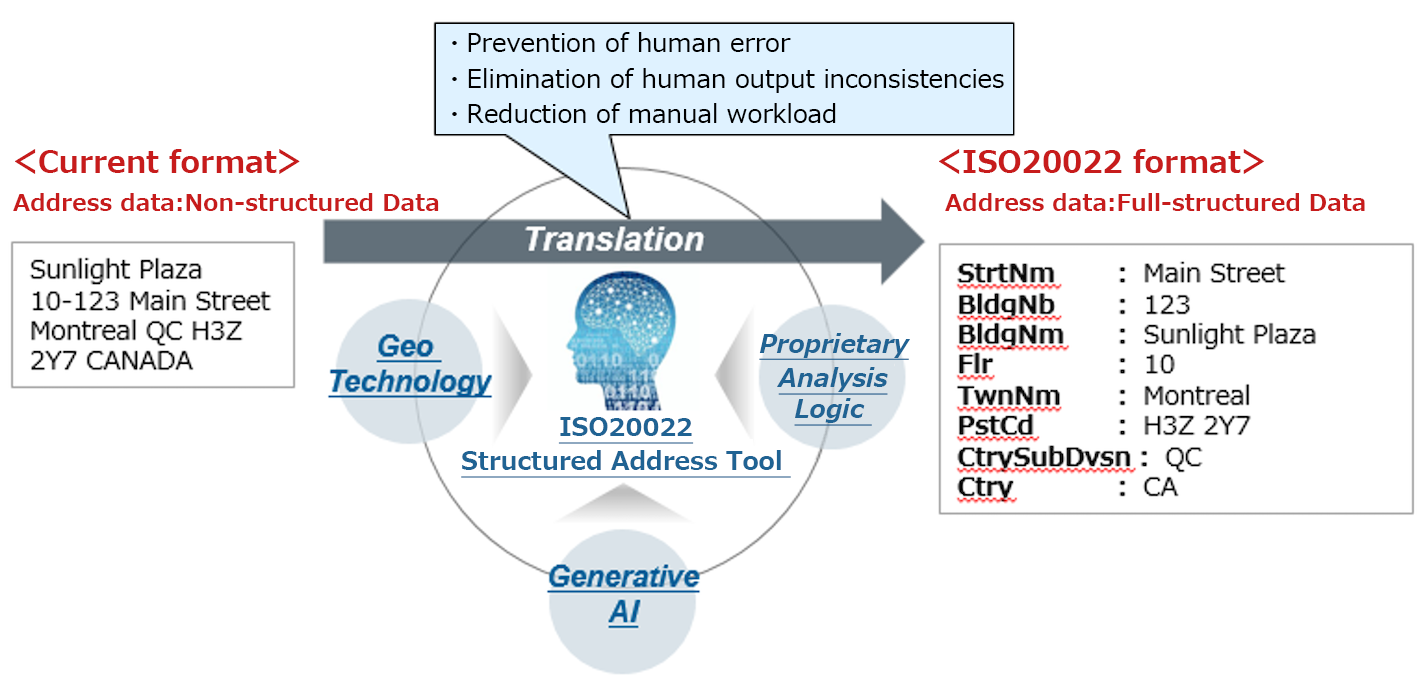

(2) Structuring Mechanism

Under the legacy MT format, address information was typically entered as a single unstructured field, combining elements such as country, state/prefecture, and city names. However, the new MX format under ISO 20022 requires address data to be structured into separate fields for each component.

This service analyzes the unique address formats of each country using proprietary logic and automatically detects and converts them using AI technologies. It enables automatic input into the granular MX format fields, such as:

Ctry (Country)

CtrySubDvsn (State/Prefecture/Region)

PstCd (Postal Code)

TwnNm (City/Town/Village)

The service is designed for all entities involved in ISO20022 migration, including financial institutions, corporations, and fintech companies. By automating the structuring process, the service significantly reduces the burden of manual investigation, formatting, and correction of inconsistent address entries. Furthermore, future enhancements will include support for hybrid formats (*5), expanding the service’s applicability to even more use cases.

Fig. 3. Conceptual Diagram of ISO Address Structuring Service

(3) Global Compatibility

Compliance with ISO20022 is not limited to Japan—it is a mandatory requirement for financial institutions and corporations engaged in cross-border payments worldwide. To support global adoption, the service is available in both Japanese and English, enabling seamless use across international markets. NTT DATA and NTT DATA Luweave plan to expand distribution in regions such as Europe, North America, and Asia, in collaboration with local group companies around the world.

Future Development

NTT DATA and NTT DATA Luweave will continue to enhance ISO20022 compliance capabilities by expanding service functionality. Future enhancements will include OpenAPI integration, enabling seamless connectivity with corporate systems and Fintech platforms. These upgrades will further streamline cross-border payment operations and ensure robust ISO20022 compliance.

Beyond the ISO Address Structuring Service, both companies will continue to harness the power of generative AI to tackle evolving regulatory requirements and operational challenges faced by financial institutions and corporations. They will continue to deliver highly efficient and reliable solutions that contribute to digital transformation across the financial industry.

- *1 ISO20022 is a global standard established by the International Organization for Standardization (ISO) in order to harmonize and standardize data formats for financial services. As a common format that enables the transmission and receipt of more data in a form suitable for system processing, it has been adopted by Swift and for domestic payments in countries throughout the world.

- *2 Society for Worldwide Interbank Financial Telecommunication

- *3 With STRUCTURIZ™, input address data can be converted to a structured address in the new Swift format (MX format) because it learns address structuring rules by leveraging a wide range of AI technologies such as natural language processing and large-scale language models. From the security viewpoint, measures are taken against retraining by generative AI and external data leakage.

- *4 The fully-structure format is a format that is compatible with all the address data component tags defined in ISO20022.

- *5 Hybrid (semi-structured) formats accommodate the mandatory elements while also allowing other elements to be set uniformly in the AddressLine field.

- *STRUCTURIZ is a registered trademark of NTT DATA Luweave Corporation.

- *Other product names, company names, and organization names are the trademarks or registered trademarks of their respective companies.

Contact Information

|

|